From Micromanagement to Strategic Insight: Transforming Time Tracking in MSPs [free ebook inside]

Master Your Finances: A Comprehensive Guide to Setting Up a Winning Chart of Accounts for Your Managed Service Provider (MSP) - Learn the Key Steps to Optimize Your Financial Management and Drive Success in Your MSP Business.

Building Out Your MSP Chart of Accounts

The one thing that every growing MSP wants to evaluate and usually improve is their chart of accounts (I will refer to it as the “COA” in most cases because hey, we just don’t have enough acronyms in this industry). Think of the chart of accounts as your filing cabinet system for the financial data that you generate. Of course, the more filing cabinets you have, the more quickly you can find information. And while that might seem hunky dory, there is a dark underside here which is that if you have so many filing cabinets with just a little bit in each one, that’s pretty inefficient. Why? Well, on one hand you need to make sure that the information gets to the correct filing cabinet. On the other hand, if you don’t have that much in the filing cabinet, is it really that helpful?

So what we want to do is find the goldilocks chart of accounts structure and then make sure that information that is flowing through your PSA (Professional Services Automation) system like ConnectWise, if putting the data in the right place.

Warning: This is NOT just an article on what you should use as your COA. What is most critical here is that whatever you choose to set up, you are doing it in a way that maps cleanly between your PSA and QuickBooks (QB Online preferably). You could have the best COA in the world, but if the data isn’t getting to the right place, it simply doesn’t matter.

Focusing on the P&L COA

For purposes of this article, we’re going to focus our filing cabinet on the chart of accounts that is associated with the income statement. This would involve the file structure for revenue, cost of sales and operating expenses (sales and general and administrative). Yes, there are COA filing cabinets for balance sheet items, but most work really is around the COA for the income statement, where companies truly measure their intrinsic profitability (revenue - expenses = profit). Let’s go.

Existing Models

There is a well respected and prevailing chart of account structure in the marketplace supported by SLI (Service Leadership Incorporated). SLI (today owned by ConnectWise), is known for its tremendous work supporting MSP’s through a network of peer groups as well as data reporting to help MSP’s benchmark their performance vs. peers on a multitude of metrics. To make submission of data easier, SLI has created a best practice chart of accounts that is very extensive and by all means, a very reasonable (and respected) structure. You can learn more about it here. There are others as well so I don’t want you to think that someone has a corner on the market. TechTribe has one to download. So does ABC Solutions. MSP Alliance can also hook you up (paid). There is no perfect COA. But here are the things to remember when constructing yours.

Best Practices

Here are the best practices to remember when constructing your chart of accounts:

- Maintain materiality: Don’t create a filing cabinet with such a small amount of activity that it really doesn’t warrant the work required to make sure it gets there. Put it in a more general bucket. For example, if you have $500 per year in some “parking and tolls” chart of account, don’t waste the energy. It is deemed as “immaterial”, as in, “It doesn’t matter”. Combine it with something else.

- Know what you want to measure: The first thing to ask is, “What do I want to know?”. How you set up your chart of accounts is designed to be in service to business questions. Here are some to get you thinking: a. What is my gross margin for managed services vs. projects vs. hardware/software sales? b. How much of my cost of sales is attributable to labor? c. How efficient is my direct labor performing? d. How efficient is my administrative labor performing? e. What is my EBITDA (Earnings before tax, depreciation and amortization)?

- Focus on gross margin: The most important aspect of the chart of accounts is really associated with revenue and the corresponding cost of sales. This is known as gross margin and you’re going to be very interested in what that is for your different lines of business.

Quick reminder on gross margin: Gross margin is equal to revenue minus cost of sales. Cost of sales represents the labor and other direct costs associated with generating that revenue. So it would be your tech costs, software and hardware most often. The reason gross margin is so important is that it will tell you whether or not the “thing” that you sell is inherently profitable. The operating expenses other than costs of sale are all there in order to help support that “thing” you sell.

A Recommended COA for "Most" Scenarios

There are of course many flavors of MSP out there to be sure. Some do application development. Others do VOIP services and even cable installation work. Others may do master MSP work and sell through other MSP’s. However, in general, most MSP’s will be well served with the following:

Note: I’m going to use chart of account numbers here as well. It is very good to use chart of account numbers as it will be much easier to do your mapping with your PSA -and- much easier to do analysis.

Revenue

Revenue is all about recognizing income in your business from the things yous ell.

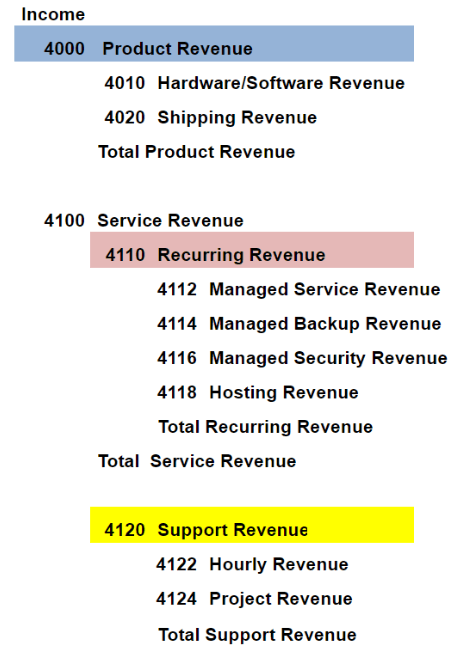

- We’ll have 2 sections here: a. 4000: Product Revenue b. 4100: Service Revenue

That was pretty easy, right? Okay, now let’s blow these out into a little more detail. Here is a visual setup for you.

Notice that we expanded Service Revenue between Recurring Revenue and Support Revenue. And then we further detailed Recurring Revenue into additional service lines. We did the same for Support Revenue (project and hourly based).

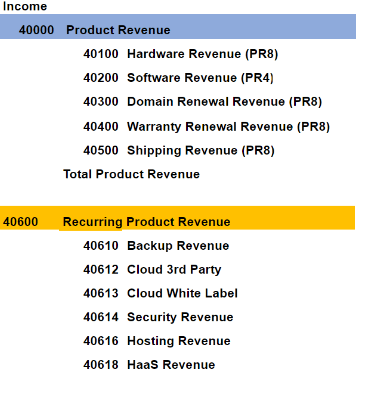

Now , we could separate product revenue between one time and recurring if that’s important in your business. If you wanted to do that, you would do so here:

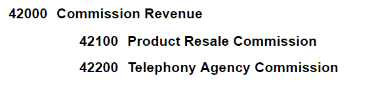

You may have various other revenue line items like commissions for instance:

Cost of Sales

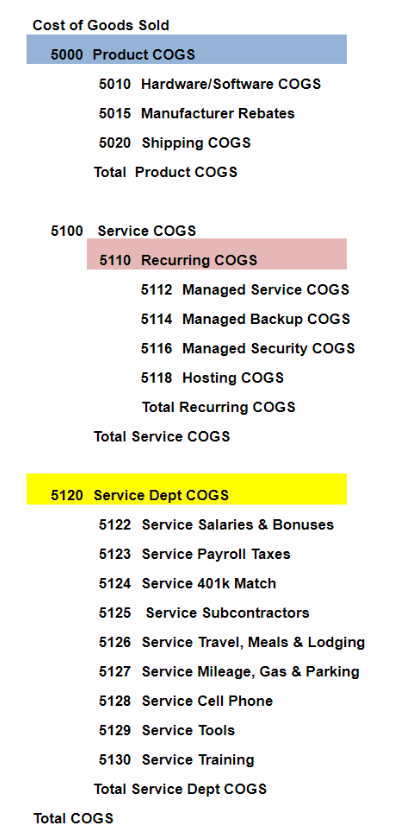

Okay, so now that you have the Revenue line items set up, we want to put together the cost of sales chart of accounts. It is important that we have the cost of sales line items that correspond to the revenue categories. That is an important concept in order to calculate gross margin.

Just like in the revenue section, we’re going to have Product COGS and Service COGS. Notice that the numbering system matches quite closely to what you saw in revenue, except this is in the “5000’s” sequencing. Also, notice that the Service Department COGS is much more expanded but that may or may not be necessary for you.

Now with your revenue and cost of sales categories set up, you can be a lot more confident in managing your business lines by analyzing your gross margin and gross margin percentage (gross margin / revenue).

Operating Expenses

Operating expenses represent the costs below gross margin. Think of them as the costs that you incur to run the business that allows you to sell your products and services. Here are the operating expenses:

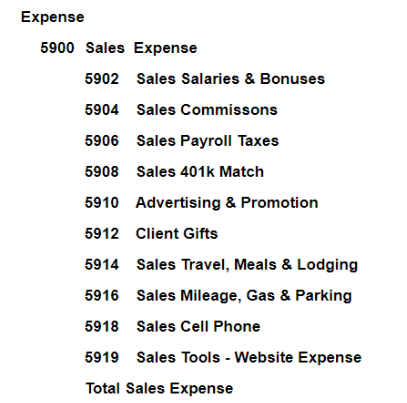

Sales Expenses

Sales expenses represent the costs associated with selling and marketing your service. There is a lot of detail here, probably more than is necessary. You can reduce it a bit. But you want this broken out because this is important data for calculating things like:

- Customer acquisition cost (CAC)

- Sales effectiveness (otherwise known as the “Magic Number”)

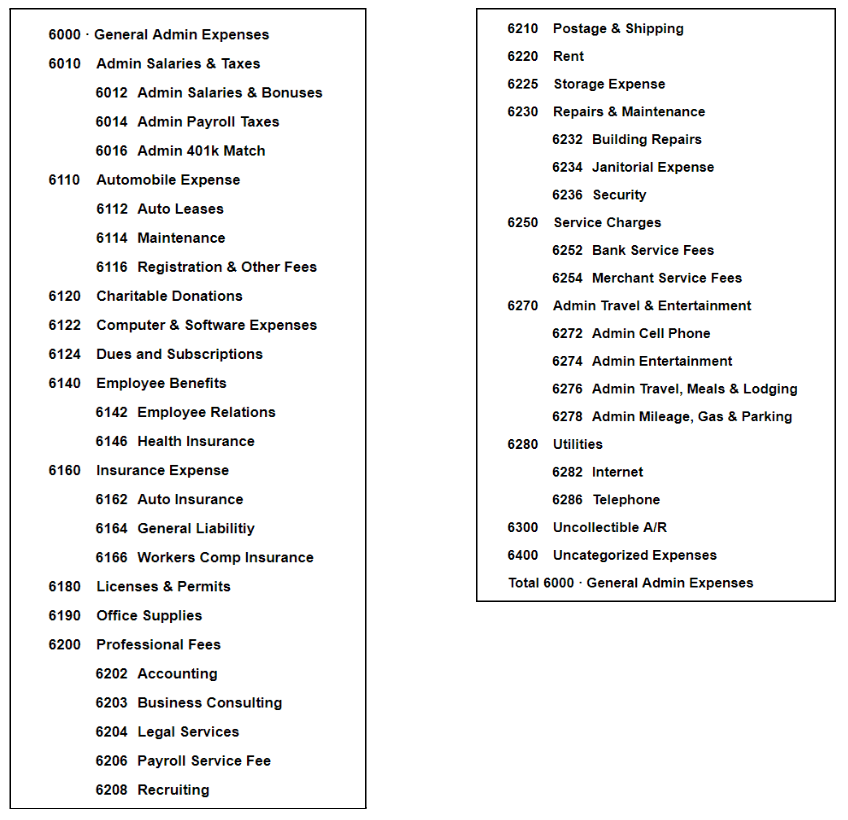

General and Administrative Expenses

Dang there are a lot of cost categories to run your MSP. General and Administrative represent some of the foundational operating costs to keep the engine running. They include administrative salaries, insurance, rent, professional fees, etc.. If you have categories here that don’t get a lot of activity, just combine two categories. You don’t get any awards for having a really long or complicated chart of accounts.

Revenue - Cost of Sales - Sales - General and Administrative = OPERATING INCOME

In other words, once you have this set up, you can calculate your pre-tax profit in the business, otherwise known as EBIT (Earnings Before Interest and Tax) or EBITDA (Earnings Before Interest and Tax and Depreciation and Amortization) assuming you don’t have any amortization or depreciation in your general and administrative costs. These are really important numbers for a couple of reasons. First, companies tend to get valued on multiple of EBITDA so the higher your EBITDA, the higher your company value. Second, EBITDA/Revenue is a very common calculation when comparing your company vs. others in your industry.

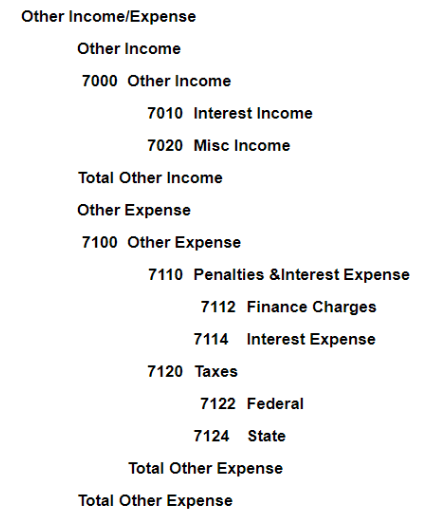

Other Income and Expenses

Other Income and Expense is typically costs associated with borrowing money (i.e. interest expense) as well as tax related charges. Once you take other income and expenses into account, you calculate your final NET INCOME number. I don’t pay a lot of attention to this part of the income statement.

You Made It

Literally, you just made your COA for your MSP Income Statement. Way to go. You learned:

- Some key benefits to an organized COA

- The rationale for breaking out your revenue and cost of sales line items

- Why separating out sales and marketing costs matters

- What exactly is G&A and why it matters

- EBIT and EBITDA

- Other income and expense logic

Of course there are nuances and at Stride, we’re happy to help you get this in place. You can email us at hello@stride.services. But we’re only just getting started. In future articles, we’re going to talk about:

- Mapping your COA to QuickBooks Online.

- Setting up your sync for success

- Considering the impact of deferred revenue and inventory on your MSP accounting

See you soon!